Understanding Bangladesh's External Debt Flows

By Mustavi Zaman Khan, CFA

Senior Investment Analyst

EDGE Research & Consulting

Posted on: 04 Sep, 2023

You might have come across some recent news articles citing private sector dues of ~USD10-12bn payable within the year. On the surface, the figure implies a substantial drag on Bangladesh’s FX reserves (presently ~USD23bn according to BPM6) and potential for further BDT depreciation. It is critical to understand, however, that the articles are referring to gross, and not net, payments.

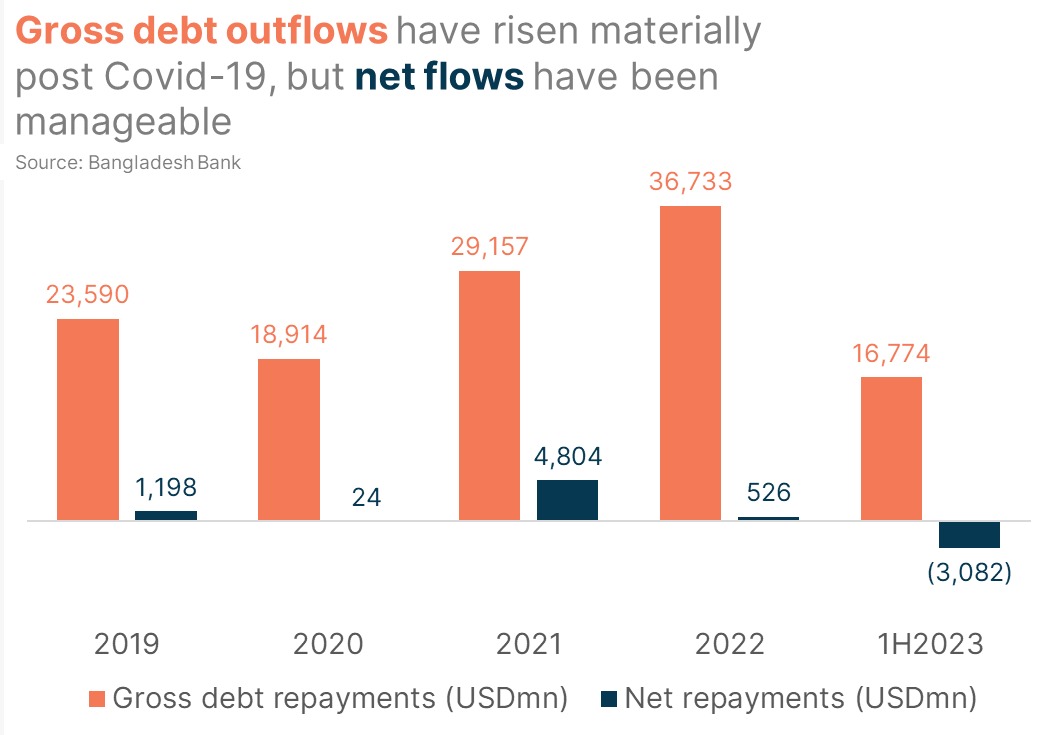

As presented in the chart below, while gross debt bills have surged 2020 onwards (driven by pile up of buyers’ credit), steady inflow of debt in the same period meant that net flows remained manageable; it is the net figure that has a bearing on FX reserves. For instance, ~USD17bn worth of debt has already been repaid during Jan-Jun 2023 but national FX reserves only fell ~USD2.5bn in the same period. You’d be right to question the conspicuous gap in these numbers. The missing piece is that the same period also saw inflows of ~USD14bn, which meant that net outflow stood at ~USD3bn.

The takeaway here is that while a large private sector bill is due this year, as long as routine inflows (typically refinancing arrangements) continue, Bangladesh should be able to foot the private sector bill without a crippling erosion of dollar reserves. Admittedly any net outflow is bad given present level. However, Current Account has been generating some surpluses which has alleviated pressures. The Financial Account is unlikely to get into large surpluses anytime soon given prevailing high US interest rates but the rate of (domestic) FX reserve depletion has certainly come down.

- Tags:

- Bangladesh, private, external, debt, dollar, currency, depreciation, BDT, taka

Search

Categories

Recent Post

-

Understanding Bangladesh's External Debt Flows

04 Sep, 2023 -

Monetary policy - where things went wrong in last cycle

25 Jun, 2023 -

Is BDT still overvalued? Market says its not.

02 Jun, 2023 -

Superapps are not convenient, so why pursue?

20 Feb, 2023 -

Investing in challenging macro environment

04 Feb, 2023

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.