Is BDT still overvalued? Market says its not.

By Asif Khan, CFA

Managing Partner

EDGE Research & Consulting

Posted on: 02 Jun, 2023

10 months ago, I wrote a post on the BDT exchange rate. The main thesis was that the sharp currency depreciation we were experiencing in 2022 was simply because the Bangladeshi taka was overvalued. For anyone interested in the BDT exchange rate outlook reading that piece first would be useful.

https://lnkd.in/g7PS3mJb

Back then the $1 was equal to around BDT95 ish. Now official exchange rate is around 107-8. Cash dollars are available at around 111 while the ‘hundi/hawala’ rate may be around 114-116.

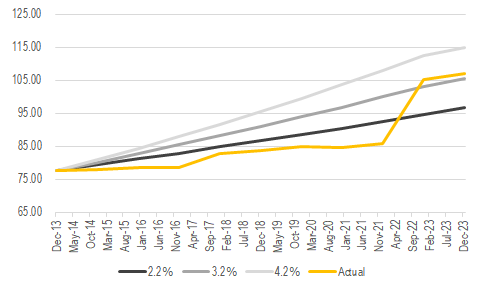

Between 2003-2013, USD appreciated around 3.2% per year vs BDT. As mentioned in the previous post, this is a reasonable level of USD appreciation (and BDT depreciation) considering the inflation differentials.

Based on the first chart below, the actual official exchange rate has now caught up with the 3.2% USD appreciation per year. The cash and hundi markets have actually exceeded the 3.2% per year and have actually touched the 4.2% per year number. A simple conclusion here is that BDT has reached close to its fair value for 2023.

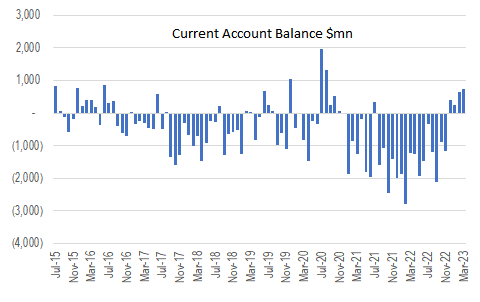

There is a simple test for seeing if a currency is undervalued or overvalued. That is following the current account balance. An overvalued currency will lead to current account deficits. As the currency moves closer to fair value the deficits should fall (and sometimes move into surplus depending on the structure of the economy).

If we look at the monthly current account numbers, after 2017 (excluding the covid period) we are now seeing consistent monthly surpluses. One challenge in looking at current account numbers is the LC openings have been severely restricted. So, one could argue that with a normalized import number, the current account situation would not have been as good. This is a logical conclusion but fails to consider a few alternate points.

1. Commodity prices have come down significantly from a year ago (IMF index down 25% YoY). So, the peak import figures of monthly $7bn ish are no longer relevant.

2. The 25% USD appreciation vs BDT that has happened automatically reduces import demand to some extent.

3. Even if monthly imports normalize at $6bn, there is a marked improvement in the current account situation compared to 2021 and 2022.

Other than the current account indicator, another indicator is the curb market US$ rate. This rate had reached a high of around 114 but has now come down to 110-111. The directional trend has been of BDT strength. Plus, the spread vs official rate has narrowed to historical averages.

Overall, the data is suggesting that BDT is close to fairly valued. This is a good sign but we still need financial accounts to improve before the economy starts to turn around. Will discuss more in part 2.

- Tags:

- Bangladesh, economy, exchange rate

Search

Categories

Recent Post

-

Understanding Bangladesh's External Debt Flows

04 Sep, 2023 -

Monetary policy - where things went wrong in last cycle

25 Jun, 2023 -

Is BDT still overvalued? Market says its not.

02 Jun, 2023 -

Superapps are not convenient, so why pursue?

20 Feb, 2023 -

Investing in challenging macro environment

04 Feb, 2023

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.